Why we worry about poverty?

What is it? absolute, relative measures,

ideal attributes of an index. Sen stuff. practical problems of determining the

line or understanding more complex issues

How can it come about? Marginal tax rates.

Risk in society. Missing markets and free rider alturism.

Why is it bad? Crime rates. People’s

morality. Missing markets of insurance.

Why not elliminated? Moral Hazard,

incentives. Discuss more fully later.

http://www.ifs.org.uk/research/personal/Incomes61_91.HTM

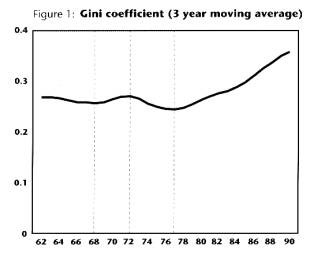

The most widely used measure of inequality

is the "Gini coefficient" which ranges between 0 (everyone has the

same living standard) and 1 (one person has all the money). Figure 1 shows how

the Gini coefficient has varied over the last three decades. The vertical dotted

lines indicate turning points in the trend in inequality.

household living standards are measured by

incomes after housing costs such as mortgage interest or rents have been paid.

One reason for the growth in inequality in recent years has been a rise in

home-ownership amongst lower income households (mainly via council house sales)

coupled with very high interest rates particularly at the start of the 1980s

and the start of the 1990s.

The real incomes of the poorest households

on this basis are little higher than 1960s. Twenty five years ago those on the

lowest incomes would typically have been living in local authority rented

accommodation and would have had their housing costs met through a combination

of central and local government subsidy. By the start of the 1990s many of the

"new poor" were those who were trying to meet high mortgage interest

repayments on the strength of relatively low earnings and with no entitlement

to social security assistance. SO

TI:

The distribution of income in the United Kingdom 1961-96: an interim

report

AU: Wyeth_R,

Burwood_L

JN: Economic affairs

[London], Jun 1997, Vol.17, No.2, pp.39-42

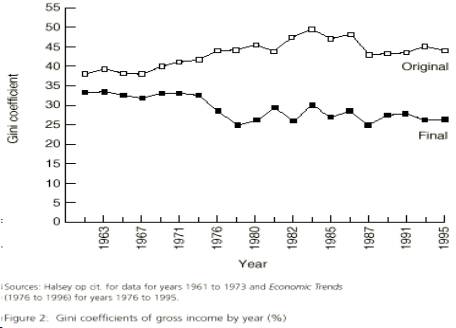

While Stark and Rowntree both show an

increase

in inequality as measured by this

coefficient, they

use gross and original incomes measures in

their

calculations. While we accept that both

these measures

of income do show an increase in inequality

over the

period we suggest that it is the

distribution of final

income that is important in considering the

degree of

inequality in standards of living. Figure 1

shows the

Gini coefficients for original income and

final income

for the years 1961 to 1995.This shows the

trend

How

do they live? Crime rate correlated

Aims of tax system: Provide incentive,

finance insurance

Possible reforms of incentive: lower

marginal rates, welfare to work. means tested

Alternative finance: more progressive

changes, alternative sources of finance other than tax system.

Action to make work more rewarding than

welfare must also take into account the existence of the 'poverty trap', which

arises when people in work cannot improve their income by working longer hours

or for higher pay, because working for more means they simultaneously pay more

tax and receive less benefit.

The Family Resources Survey suggests that

at present about 100,000 working people face marginal deduction rates of more

than 90 per cent

Aims: provide relief for poverty

Reforms: incentives to get out themselves.

Provide enough benefit so they wont be in poverty. Then moral hazard and

incentives.

In the modern labour market the government

retains important responsibilities. It must:

provide a framework for macroeconomic

stability and growth, which prevents the swings in output that destroy jobs and

create a pool of long-term unemployment;

promote a flexible and adaptable labour

market, backed up by a framework of minimum standards, and ensure that firms

and their employees respond effectively to structural change;

encourage investment in education and

skills, so that people start off their working life with the basic skills

required for a lifetime of work, and can learn through life and remain

employable as the labour market changes;

help move people from welfare to work, by

focussing help on the unemployed and those detached from the labour market, and

developing a framework of rights and responsibilities;

make work pay, through a national minimum

wage and a tax and benefit system that promotes work incentives.

First, a new tax credit paid to families on

low incomes, directly through the wage packet. In principle, a working

family tax credit has a number of attractions. It could reinforce the

effect of the minimum wage by making work pay. It could build on the success of

Family Credit, increasing potential in work incomes and therefore the incentive

to work. As a tax credit rather than a welfare benefit it should result in

higher take up, while its clear link with the pay packet and the tax system

should demonstrate the rewards of work over welfare. A working family tax

credit could provide a highly effective way of targeting help at low income

families: as well as improving work incentives, it could also help reduce

poverty and strengthen the family. A critical test will be whether it can be

delivered effectively and efficiently. Secondly, national insurance

contributions, the current structure of which places a heavy

burden on low paid workers and risks distorting the labour market. There is

scope for bringing the national insurance structure more into line with income

tax to ease administrative burdens on employers, to improve work incentives and

to encourage the hiring of additional employees. However, the pace of reform

must depend on the availability of resources. Thirdly, the 10p rate of

income tax which the Government is committed to introducing as soon as

it is prudent to do so. A lower starting rate of income tax would create a

fairer tax system, reducing the tax burden on the low paid. Fourthly, the Government

is determined that the working poor should benefit from the 10p rate and any

future reductions in income tax. It is therefore considering what action is

necessary on the tapers and other features of the benefit

system to ensure that a lower starting rate of income tax benefits all the low

paid.

Private institutions – libertarian

Poverty has been called one of the evils of

the modern society. For some reason rational individuals are against it even

when they have no risk of getting into poverty themselves (savings to provide

subsistence can usually be accumulated with far less resources than have to be

paid as national insurance contributions). Still, people care about other

people’s poverty as well, and this makes the analysis somewhat more

complicated. The reasons for caring about others is probably to do with culture

and Freudian behaviour in childhood, it is very hard to deduce macroeconomic

policies from these premises, however, one can evaluate different policies by

predicting altruistic human action. This is what I will try to do in this

essay: first look at the possible tax and social security system reforms that

are justified economically, and then see whether they would actually work.

So, what is poverty? There are two different measures: absolute and relative. Absolute is to do with starvation and subsistence, relative with social participation. In practice one normally uses a relative measure, say everyone whose income is below 40% of the mean national level is in poverty. This is measurement, although easy to interpret, is highly subjective as to where one draws the line. Furthermore, it shows no indication as to how deep in poverty the people actually are. Sen has produced a better index, one that uses a combination of income and Gini coefficient to measure the inequality. However, most empirical research is just concerned with the relative incomes of top and bottom decile, the approach I am going to adopt here.

When the markets are working perfectly either no poverty occurs or its extent wouldn’t worry anyone. Its existence implies that there are distortions to Arrow-Debrew economy. I will briefly describe three: income taxes, free rider problems in altruism and missing risk insurance markets.

First, only lump sum taxes guarantee a Pareto-optimal efficient outcome. With income taxes, people will not get the full benefits of their labour. The higher is the marginal tax rate, the less motivated people are to work. Now, with high amounts of benefits at the lower end of the income scale for people who work very little (unemployed) they might well choose not to work, as it is not worthwhile.

Secondly, there is a problem with complementary consumption. Normally, if your consumption benefits me, I can just give you money and be happy. With poverty it is the consumption of the group of people that affects me and everyone else. My contribution to the increase of their consumption is insignificant, so I choose not to contribute and free ride. If everyone else does that we have very little altruism.

Lastly, it should be possible for people to insure themselves against poverty. However, people are mostly born into poor families, so they wouldn’t be able to finance the premiums. The solution to that is a comprehensive insurance with the same premiums for everyone. This system will have moral hazard problems and again creates high marginal tax rates.

Poverty is bad first, because people do not like it and secondly, because of missing markets in insurance. There is actually too little consumption of goods that people desire. Furthermore, if one is below subsistence level one cannot work, so there are increasing returns to scale for some food, again giving rise to improvement. Finally, crime rates are highly correlated with poverty.

I will now turn to evidence on poverty in UK. It is the common view that poverty has increased over the past years. The most widely used measure of inequality is the "Gini coefficient" which ranges between 0 (everyone has the same living standard) and 1 (one person has all the money). The figure below shows how the Gini coefficient has varied over the last three decades. The vertical dotted lines indicate turning points in the trend in inequality:

http://www.ifs.org.uk/research/personal/Incomes61_91.HTM

However, in this survey household living

standards are measured by incomes after housing costs such as mortgage interest

or rents have been paid. One reason for the growth in inequality in recent

years has been a rise in home-ownership amongst lower income households (mainly

via council house sales) coupled with very high interest rates particularly at

the start of the 1980s and the start of the 1990s.

The real incomes of the poorest households on this basis are little higher than 1960s. Twenty five years ago those on the lowest incomes would typically have been living in local authority rented accommodation and would have had their housing costs met through a combination of central and local government subsidy. By the start of the 1990s many of the "new poor" were those who were trying to meet high mortgage interest repayments on the strength of relatively low earnings and with no entitlement to social security assistance.

However, Wyeth and Burwood have rejected these measurements (The distribution of income in the United Kingdom 1961-96: an interim report, Economic affairs [London], Jun 1997, Vol.17, No.2, pp.39-42). They say it is correct to look at final disposable income. Current studies show an increase in inequality as measured by gross income Gini coefficient. They use the distribution of final income Gini coefficients to calculate the degree of inequality in standards of living.

Figure below shows the Gini coefficients

for original income and final income for the years 1961 to 1995:

This clearly shows that the benefit system has served to reduce the inequality, a remarkable result from the conservative government. It is not surprising, however, when one looks at the increased welfare spending over the years. The original income is expected to show an increase in inequality because marginal tax rates were reduced dramatically, so no wage drift occurred.

It is still believed by many that, one can

improve on the tax system to reduce the poverty even further. The belief is grounded

on the fact that we should measure poverty as ability for social participation.

Absolute poverty has been virtually eliminated already in western countries,

and relative poverty can never be eliminated anyway. However, to make some

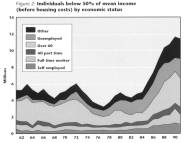

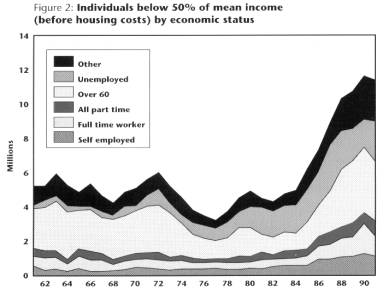

progress I have to look at the trends in poverty lately:

This shows that most of the poverty is due to pensioners, an obvoius fact because their incomes are indexed with price level and they automatically become poor as economy grows. However, there is also an increase of full-time employment poverty and decrease in unemployed poverty. This can be accounted by the tax system being more favourable for poor who work. Still it is clear that many workers will not be able to support themselves while working. This supports the introduction of minimum wage. However, then the trend might be reversed (Lucas critique).

The most feasible tax reform one can imagine

is to reduce marginal tax rates for the poor. Indeed, there are numerous

evidence of ‘poverty trap’, which arises when people in work cannot improve

their income by working longer hours or for higher pay, because working for

more means they simultaneously pay more tax and receive less benefit. The

Family Resources Survey suggests that at present about 100,000 working people

face marginal deduction rates of more than 90 per cent. As the actual marginal tax

rate for the poor is very low already (20% compared to 40% at the top end)

there is not much that the tax reform can do. I will look at the benefits

reform a bit later. Still, the present government is committed to introduce a

10% minimum tax rate. Its effectiveness as opposed to just political popularity

remains to be seen.

Turning away from actual figures and going into the theory of tax system, poverty is essentially eliminated by transfers from rich to poor. So one could make the poverty disappear by transferring enough. However, this would conflict with other aims of the public policy. It would be unfair and eliminate incentives. One can argue that starvation produces no incentives anyway. However, in this case we are talking about relative poverty, which can feasibly be a motivating factor for work. Anyway, from the theory point of view, the tax system should be least distorting for it to allow maximum feasible transfers. No distortion arises from common lump-sum taxes. However, these are impossible to implement, as people will not reveal their endowments. A Groves endowment revealing mechanism can be used, but this is usually wasteful. Diamond and Mirrlees have investigated the possibility of income taxes. These are preferable in asymmetric information cases, where workers know their ability better than the government. However, no clear conclusions as to which forms of taxation are optimal arise from the literature. The only policy recommendation seems to be to lower the top marginal tax rate in order to gain most revenue with least distortions (Mirrlees).

One possible reform is a negative income tax. This means that the state is transferring money instead of social securities, giving individuals freedom to choose. However, no country has adopted this system because with a typical income distribution it would cost too much and raise the marginal tax rates to unacceptable levels.

It seems that purely changing the tax reform will not help much and one must look at the social security as well. The aim on the social security is to distribute the tax revenues to provide relief for the poor. It must do so by least amount of distortion and as cheaply as possible. This essentially means targeting and means testing. As there are two main forms of social security in western countries – health care and education, it seems logical to give them free to poor. This is indeed what has happened. One could say that it costs more, on the other hand, rich are more willing to contribute when they know that poor receive something that rich think is good (education as opposed to cigarettes).

There are a few things that government can do to the social security systems on the lines discussed above. The present government has decided to help move people from welfare to work, by focussing help on the unemployed and those detached from the labour market, and developing a framework of rights and responsibilities. It tries to “make work pay”, through a national minimum wage and a tax and benefit system that promotes work incentives. First, they have introduced a new tax credit paid to families on low incomes, directly through the wage packet. In principle, a working family tax credit has a number of attractions. It could reinforce the effect of the minimum wage. As a tax credit rather than a welfare benefit it should result in higher take up, while its clear link with the pay packet and the tax system should demonstrate the rewards of work over welfare. Secondly, government thinks that there is scope for bringing the national insurance structure more into line with income tax to ease administrative burdens on employers, to improve work incentives and to encourage the hiring of additional employees. They have reduced the employer’s contributions to make workers more employable.

Finally there are number of attractive

alternatives to reducing poverty without state intervention. It is common to

exaggerate the effect of market failures. According to Coase’s theorem, as long

as the property rights are well defined there will be no market failure. And

although one cannot precisely know how private markets will enforce the

property rights, they have done so remarkably well in the past. For example,

they have overcome the free rider problem of charity contributions by assigning

a particular poor family to each benefactor, so that their contributions are significant

in a group. Many libertarians argue that the government in essence competes

with private charities. As it has more resources, it is bound to win.

Furthermore, by introducing legislature, it very often discriminates against

poor (housing regulation is a prime example). So there is a case of reducing

government involvement and letting private markets deal with poverty, as they

did in the 19th century Victorian era. However, people are risk

averse, and as they cannot predict the outcome of the private markets, they

will tend to choose government intervention instead.